Posts by Nicholas dePencier Wright

Becoming a Charity – Video

Always wondered about the process for becoming a Canadian charity? Watch this information session with Nick Wright on how to get registered.

Read MoreA Primer on Canadian Limited Partnerships

The Limited Partnerships Act (Ontario) is a piece of legislation that allows for the creation of limited partnerships with the characteristics of a general partnership but without joint and several liability for certain ‘limited’ partners.

Read MoreRegistering a Canadian Limited Partnership

The Canadian Limited Partnership or “LP” is a business entity that has gained popularity among those engaged in international transactions and holdings including foreign investors and those with assets outside of Canada.

Read MoreOntario Bill 190 Expands Digital Business/Legal Services

COVID-19 has provided the perfect opportunity to overhaul some of Ontario’s outdated regulatory standards.

Read MoreExempt Market Offerings in Ontario

Under what circumstances can companies issue exempt offerings in Ontario?

Read MoreHow to Set Up an Exempt Market Dealer

Wondering how to set up an exempt market dealer in Canada? Read on.

Read MoreGetting to Know Exempt Market Dealers (EMDs)

What is an exempt market dealer, and when do you need one?

Read MoreCRA Increasing Global Enforcement

We live in a world of rootless capital, where finance flows readily across borders. Many businesses operate internationally with resulting assets held in multiple jurisdictions. These intricate, globe-straddling financial portfolios have been the bane of tax authorities, tasked with monitoring and enforcing tax liabilities on assets held abroad. Blind spots – jurisdictions that the authorities…

Read MoreRestrictions on Political Activities for Charities Struck Down

Canadian Charities take note: a fundamental shift has occurred in how the Canada Revenue Agency regulates political activities, one that may significantly change the way that charities engaged in non-partisan political activities structure themselves and operate. Though punctuated by the Trudeau government’s recent decision to drop its appeal against a 2018 court ruling that struck…

Read MoreOntario Offering Memorandum Exemption a Win-Win

One of the most significant regulatory developments of the past few years regards changes to offering memorandum exceptions, and every Canadian business owner and investor should be aware of how these new rules work. In 2016, a set of new amendments from provincial securities regulators came into force. They introduced an offering memorandum prospectus…

Read MoreEstate Freezes

Estate freezes are used by family business owners to facilitate the transfer of a business from one generation to the next while taking advantage of available tax deductions and incentives. They are generally structured to minimize capital gains tax and probate fees and to take advantage of dividend sprinkling to income split among family members,…

Read MoreS.85 Tax Exempt Transfer to a Corp

Section 85 of the Income Tax Act is a commonly used provision that permits the tax exempt transfer of property to a corporation. This paper provides an overview of the application of the section covering key topics including the general rules of section 85, eligible property, consideration or “boot,” anti-abuse rules, requisite filings and other…

Read MoreNAFTA Domestic Tax as Trade Subsidy

This paper argues that North American Free Trade Agreement (NAFTA) renegotiation and amendment should be used to define and restrict domestic tax provisions improperly used as indirect trade subsidies or tariffs. In doing so the Canadian foreign affiliate rules and the proposed US border adjustment tax are examined.

Read MoreCanada-Barbados Tax Treaty

This paper explains how to use the Canada-Barbados Tax Treaty to avoid Canadian tax on international business income.

Read MoreUS Real Estate Tax Issues

This paper provides an overview of relevant tax considerations when a Canadian resident is purchasing US real estate and discusses different ways to structure a purchase to minimize tax exposure.

Read MoreUsing a Family Trust in Business

The discretionary family trust is a tool used by some business owners to reduce tax liability and increase flexibility in the family economic unit by facilitating tax-favourable distribution of funds, business succession and estate planning. Using a discretionary family trust to hold shares in a private company can have significant tax and planning benefits. This…

Read MoreBusiness Sale Tax Considerations

The purchase and sale of a private incorporated company in Canada raises a variety of important tax considerations. This paper provides an overview and analysis of such considerations and argues that the clear public policy objective of promoting small business in Canada using provisions of the Income Tax Act has been undermined by an unnecessarily…

Read MoreShare Sale or Corporate Redemption?

Frequently when restructuring a closely held private corporation shareholders must decide whether to transfer shares from one shareholder to another with a share purchase and sale or to have the corporation redeem (i.e. buy back) the shares from the shareholder, resulting in a reduction in the total number of issued and outstanding shares and increased…

Read MoreCRA Voluntary Disclosure Program

The Canada Revenue Agency’s Voluntary Disclosure Program promotes voluntary compliance with Canada’s tax laws by encouraging taxpayers to come forward and correct deficiencies in their tax filings on a penalty exempt basis. This paper provides an overview of the existing Voluntary Disclosure Program, analyses the programs current use and argues in favour of amendments to…

Read MoreThe Due Diligence Defence

What is due diligence and why is it important? “Due diligence” is a context-specific determination referring to the level of judgment, care, prudence, determination, and activity with which a person would reasonably be expected to act. In business dealings, establishing due diligence – that you, as either an officer or a director of the corporation…

Read MoreHow to Set up a Co-operative

A cooperative or “co-op” refers to an incorporated business organization owned by members sharing common needs or goals. Incorporation presents a number of advantages to its members, namely the co-op’s separate legal existence, limited liability for the members, and general agreement to basic principles on how the organization will operate.

Read MoreThe Decline of the Successful Tax Shelter

This essay reviews the Income Tax Act (Canada) (the “Act”) tax shelter provisions and provides an overview of relevant issues to demonstrate that despite criticisms that the provisions and Canada Revenue Agency (“CRA”) enforcement are overreaching, it has been successful in prohibiting, preventing and reassessing participants in aggressive tax shelter programs. It argues that issues…

Read MoreBuying or Selling a Business? Read This

There are two main ways to buy or sell an incorporated business: buying and selling its assets or buying and selling its shares. An asset purchase and sale consists of selling the corporation’s tangible (e.g. inventory and equipment) and intangible (e.g. goodwill and intellectual property) assets. Buyers often prefer asset sale transactions because business liabilities…

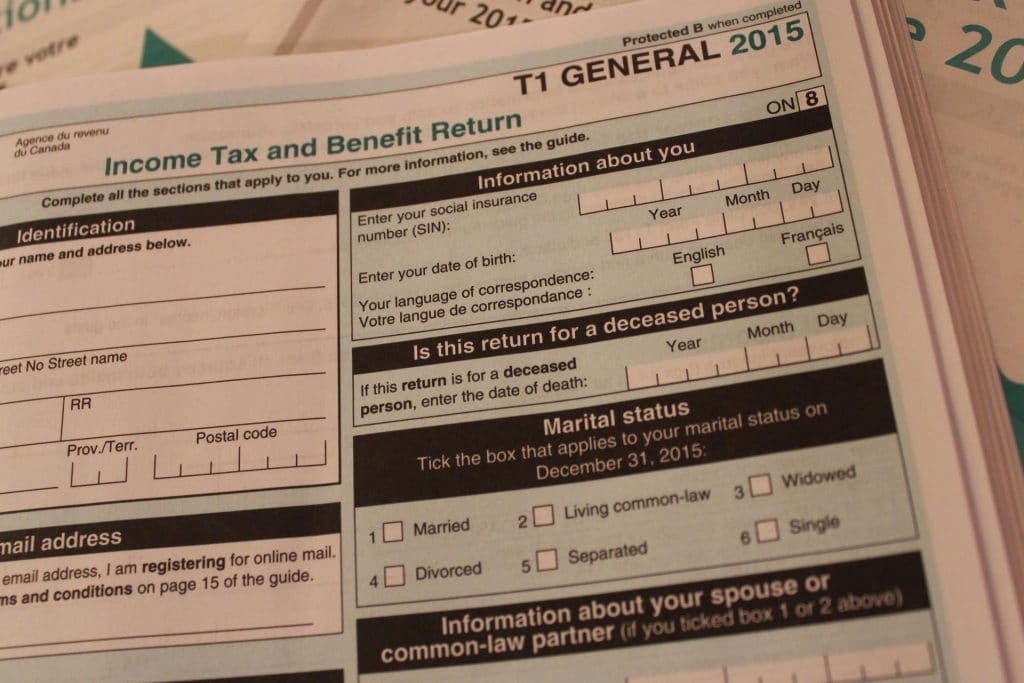

Read MoreHow to Register a Charity

In common usage, the word ‘charity’ is often used to refer to any not-for-profit organization. However, legally, registered charities and non-registered not-for-profit organizations are treated differently for tax purposes in important ways. While not-for-profits are generally exempt from income tax, registered charities have broader tax exemptions including the ability to issue charitable tax receipts to…

Read MoreIncome Tax General Anti-Avoidance Rule

This paper provides an overview of the Canadian General Anti-Avoidance Rule (“GAAR”) including its history, legislative intent, implementation, resulting policy issues and judicial treatment. It argues that GAAR is vague, contrary to the doctrine of legal certainty and grants broad discretion to the government bodies tasked with its review and enforcement. While judicial treatment of…

Read MoreShareholder Agreements: A Primer

What is a shareholder agreement? A shareholder agreement is an agreement between the shareholders of a corporation establishing the rights of the company’s shareholders as well as the management of the corporation. Why is it important to have a shareholder agreement? The shareholder agreement is intended to ensure that shareholders are treated fairly and that…

Read MoreProfessional Incorporation in Ontario

What is professional incorporation? Professional incorporation allows regulated professionals to offer their professional services (as well as any related or ancillary services) while enjoying many of the tax (deferring tax, small business exemptions, etc.) and non-tax advantages available to other incorporated self-employed individuals. Who qualifies as a ‘regulated professional’? The professions eligible for professional incorporation…

Read MoreWhy to Register your Copyrights

What is a copyright? S. 3 of the Copyright Act explains that ‘copyright’ refers to the sole right to produce or reproduce a work or a substantial part of it in any form. It encompasses the right to perform the work, or publish the work, if the work is unpublished. Copyright covers original works including…

Read MoreProtecting Your IP Checklist

If you’re ready to protect your Intellectual Property, use this checklist to ensure you’re taking all the necessary steps to secure your copyrights and trademarks. If you are still unsure about the reasons to trademark or copyright your IP make sure to read the previous articles, 5 Reasons to Trademark Your Business Name & Logo…

Read More5 Reasons to Trademark Your Logo

In Canada, trademarks may be registered or unregistered. Trademark registration is governed by the federal Trade-Marks Act. The Trade-Marks Act establishes a regime under which applicants apply to have their trademarks registered into the Register of Trademarks, the record of all formally applied for and registered trademarks in Canada. There are many reasons why registering…

Read More